New batch starts soon! Limited seats...hurry!

180+ hours of immersive, in-person training in Mumbai designed by a former COO (Standard Chartered, India Markets) to make you job-ready for investment banking operations roles.

Ideal for: Final-year students, fresh graduates, and young finance professionals

Limited seats: 15 students per batch

Investment Banking Operations Certificate (IBOC) – Classroom Program in Mumbai

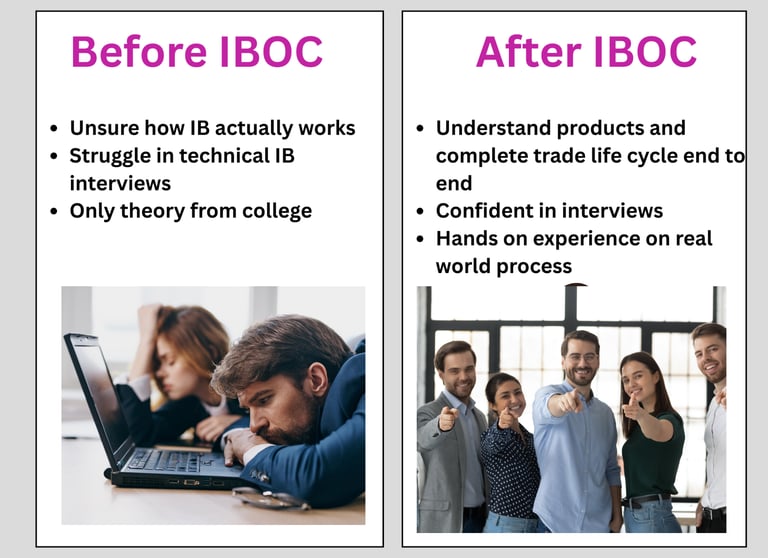

Why Most Finance Graduates Struggle to Break into Investment Banking Operations

Degrees focus on theory, not real-world investment banking workflows.

Most candidates can’t explain trade life cycle, settlements, or risk in interviews.

Recruiters look for hands-on skills, not just marks.

No structured guidance on how to position yourself for IB operations roles.

What If You Could…

Confidently explain the end-to-end trade life cycle in an interview

Understand how global markets, risk, and operations really work

Showcase real project work instead of just textbook knowledge

What You Get with the Investment Banking Operations Certificate (IBOC)

Format: In-person, classroom training in Mumbai

Total Training: 180+ hours of guided sessions

Batch Size: 15 students (15:1 student-to-instructor ratio)

Who It’s For:

Final-year commerce/finance students

Fresh graduates

Young professionals (0–3 years) looking to move into IB operations

Outcome: Job-ready skills for roles in investment banking operations and risk functions.

Skills You’ll Master with IBOC

IB Operations Fundamentals

Trade life cycle, settlements, confirmations

Front office vs Middle office vs Back office

Financial Products

Global markets overview

IB Operational Risks and Control

Operational risk management in IB

Reconciliations, exception management and escalations

Regulatory and compliance reporting

Practical Tools & Workflows

Excel for operations and reporting

Real-world case studies and process simulations

Capstone projects and assignments

Career & Interview Readiness

Mock interviews with real IB-style questions

CV positioning for IB operations roles

Presentation and communication practice

Where IBOC Can Take You

Typical roles our students target after IBOC

Middle Office Analyst

Book, affirm, confirm and reconcile trades with Trade booking systems and counterparties

Risk and Control Analyst

Manage the operational risks of a trading desk

Investment Banking Operations Analyst

You will be working with the traders and risk managers on various business projects

Learn Directly from an Industry Veteran

Mitul Mewada is a seasoned finance professional with over 20 years of experience in the financial services sector. With a background in business management, operational risk management, product control, middle and back office operations, client management, global stakeholder engagement, change management, and business governance, Mitul has honed his skills in front office as well as various middle and back office functions. He excels in client management and global stakeholder engagement, utilizing systematic working methodology and strong analytical skills to drive results.

Throughout his career, Mitul has held various leadership positions, including serving as the former Chief Operating Officer (COO) for India Markets at Standard Chartered. Prior to this role, he contributed his expertise at renowned institutions such as J.P. Morgan, D. E. Shaw, Credit Suisse and other firms. He is recognized as a dynamic leader who brings strategic vision and operational excellence to every role he undertakes. With a passion for empowering individuals in the finance industry, Mitul is committed to sharing his wealth of knowledge and experience.

Mitul Mewada

Founder

Why I started Möbius Strip Academy

Real-world finance skills. Not just theory.

After 20 years of leading teams in Investment banks, I saw too many talented graduates struggle with the leap from textbooks to the banks. That’s why I built Möbius Strip Academy’s IBOC program. Here, we focus on real case studies, practical assignments, and the skills Mumbai’s top finance firms demand.

Curious how hands-on learning can reshape your career path? Let’s connect or reach out for a one-to-one conversation.

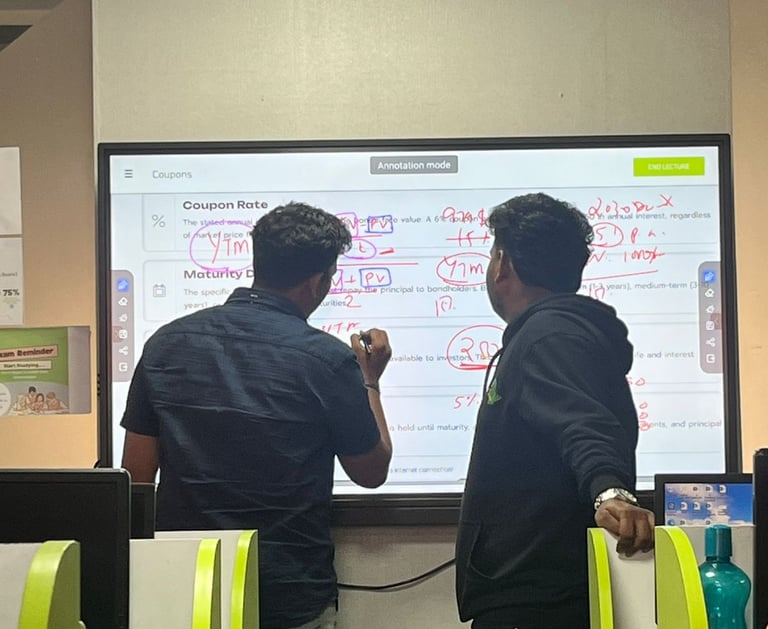

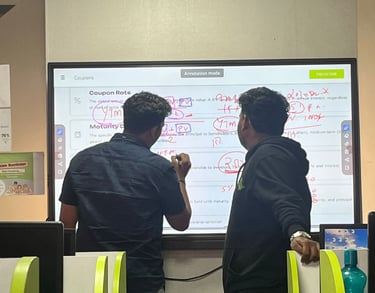

What the Learning Experience Looks Like

Interactive, in-person sessions (no boring lectures)

Real case studies and simulations from global markets

Assignments, presentations, and mock interviews

Ongoing support and guidance even after the program

We Don’t Just Train You – We Help You Get Ready for the Job Market

1:1 career guidance and profile review

Mock interviews and feedback

Support in preparing for IB operations interviews

Guidance on resume building

Soft Skills training

Investment & Batch Details

Limited to 15 students per batch for personal attention.

Flexible payment options: full payment or installments.

Occasional merit-based or early-bird discounts.

FAQs

You’ve made it to the bottom – which means you’re seriously considering your next big move. Still wondering about fees, placements, or how this program actually works in real life? Don’t guess. Our FAQ has the real, no-fluff answers. Click through now to uncover everything you need to know before you lock in your decision and secure your edge in investment banking.